Checking out the Advantages of an Offshore Trust for Wealth Security and Estate Preparation

An overseas Trust can offer significant benefits when it comes to safeguarding your riches and preparing your estate. This strategic tool not just secures your properties from lenders yet additionally provides privacy and possible tax obligation advantages. By understanding just how these trust funds function, you can tailor them to fit your distinct requirements and values. But what specific elements should you think about when developing one? Let's check out the key benefits and considerations that could affect your choice.

Understanding Offshore Trusts: Meaning and Fundamentals

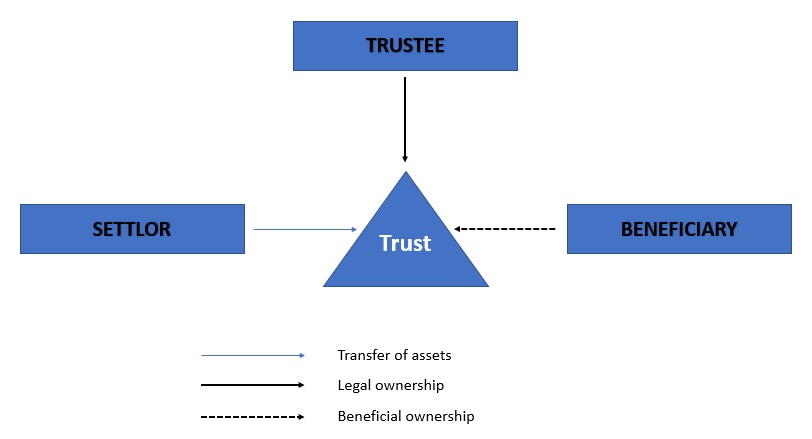

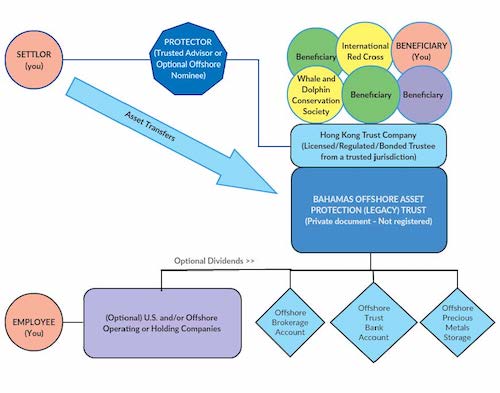

When you're exploring methods to safeguard your riches, comprehending offshore depends on can be important. An overseas Trust is a lawful plan where you transfer your assets to a count on managed by a trustee in an international territory. This arrangement supplies a number of benefits, consisting of tax obligation advantages and enhanced personal privacy. You preserve control over the Trust while safeguarding your assets from regional lawful cases and prospective creditors.Typically, you would certainly develop the count on a territory that has positive laws, assuring more robust asset protection. This indicates your wealth can be secured from suits or unexpected financial difficulties back home. It is essential, though, to recognize the lawful implications and tax obligation responsibilities associated with handling an offshore Trust. Consulting with a financial advisor or legal expert is sensible, as they can guide you with the intricacies and warranty conformity with international laws. With the best method, an offshore Trust can be a powerful device for guarding your wide range.

Asset Security: Protecting Your Riches From Lenders

When it pertains to securing your wide range from financial institutions, comprehending the lawful structure of offshore depends on is vital. These trust funds supply substantial benefits, such as enhanced personal privacy and confidentiality for your possessions. By using them, you can develop a solid obstacle versus possible cases on your wealth.

Legal Structure Perks

While many people look for to expand their riches, protecting those assets from prospective lenders is equally critical. An offshore Trust provides a durable lawful framework that enhances your asset defense method. By establishing your rely on a territory with positive legislations, you can efficiently secure your riches from legal actions and cases. These jurisdictions typically have strong privacy regulations and minimal access for exterior parties, which indicates your assets are much less vulnerable to lender activities. Furthermore, the Trust structure supplies lawful splitting up between you and your properties, making it harder for creditors to reach them. This positive technique not just safeguards your wide range yet also ensures that your estate planning objectives are met, permitting you to attend to your liked ones without unnecessary danger.

Privacy and Privacy

Privacy and confidentiality play a pivotal duty in property defense techniques, especially when utilizing overseas trust funds. By establishing an overseas Trust, you can keep your financial events very discreet and protect your possessions from potential creditors. This suggests your wide range continues to be less accessible to those looking to make cases versus you, supplying an added layer of safety. Furthermore, lots of territories supply solid privacy regulations, ensuring your info is protected from public examination. With an overseas Trust, you can appreciate the peace of mind that comes from understanding your properties are secured while maintaining your anonymity. Inevitably, this level of privacy not just shields your wealth yet additionally boosts your overall estate preparation strategy, enabling you to focus on what genuinely matters.

Tax Obligation Advantages: Leveraging International Tax Obligation Rule

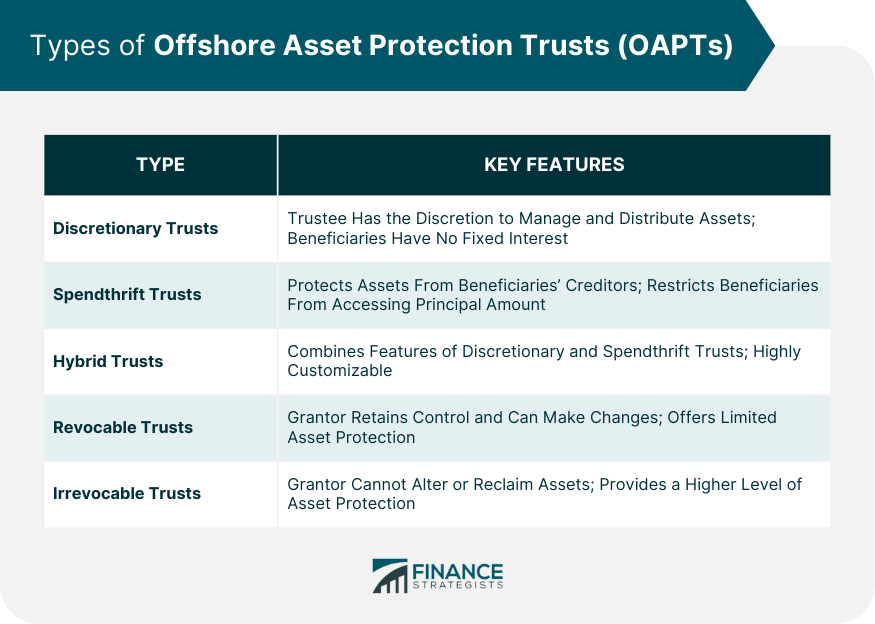

When you think about offshore counts on, you're not simply shielding your assets; you're additionally taking advantage of worldwide tax obligation motivations that can significantly reduce your tax worry. By purposefully positioning your riches in territories with desirable tax obligation laws, you can improve your possession defense and decrease inheritance tax. This approach allows you to appreciate your wealth while guaranteeing it's secured versus unforeseen challenges.

International Tax Obligation Incentives

As you check out offshore trust funds for wide range protection, you'll find that worldwide tax rewards can substantially improve your financial strategy. Several jurisdictions offer favorable tax treatment for counts on, permitting you to decrease your general tax obligation concern. For example, specific nations give tax obligation exemptions or lowered rates on revenue produced within the Trust. By tactically placing your possessions in an offshore Trust, you may additionally gain from tax obligation deferral choices, postponing tax obligations till funds are taken out. Additionally, some jurisdictions have no resources gets tax obligations, which can additionally increase your investment returns. offshore trust. This suggests you can optimize your wealth while lessening tax obligation obligations, making global tax incentives an effective tool in your estate intending arsenal

Property Protection Methods

Inheritance Tax Minimization

Developing an overseas Trust not just safeguards your possessions yet also provides substantial tax obligation advantages, particularly in inheritance tax reduction. By placing your riches in an offshore Trust, you can capitalize on favorable tax obligation regulations in different jurisdictions. Numerous countries enforce reduced inheritance tax prices or no inheritance tax in any way, allowing you to preserve more of your wide range for your heirs. In addition, because possessions in an offshore Trust aren't typically considered part of your estate, you can additionally decrease your estate tax responsibility. This calculated step can cause substantial financial savings, guaranteeing that your beneficiaries obtain the maximum take advantage of your hard-earned riches. Ultimately, an offshore Trust can be a powerful tool for reliable estate tax preparation.

Personal privacy and Privacy: Keeping Your Finance Discreet

Estate Planning: Guaranteeing a Smooth Transition of Riches

Keeping personal privacy with an overseas Trust is simply one aspect of riches management; estate preparation plays an essential role in ensuring your properties are handed down according to your dreams. Efficient estate preparation permits you to detail just how your wide range will be dispersed, reducing the risk of family conflicts or legal obstacles. By plainly specifying your intents, you aid your heirs recognize their duties and responsibilities.Utilizing an offshore Trust can streamline the process, as it commonly provides you with an organized method to manage your possessions. You can assign beneficiaries, define conditions for inheritance, and also describe specific usages for your riches. This calculated technique not only protects your possessions from potential lenders but also assists in a smoother adjustment during a challenging time. Eventually, a well-crafted estate plan can secure your heritage, giving you comfort that your liked ones will be taken care of according to your dreams.

Adaptability and Control: Tailoring Your Depend Fit Your Requirements

When it concerns customizing your offshore Trust, flexibility and control are key. You can tailor your pop over to these guys depend meet your specific demands and preferences, guaranteeing it aligns with your financial objectives. This flexibility allows you to decide how and when your assets are distributed, offering you assurance that your wide range is handled according to your wishes.You can pick recipients, established problems for distributions, and also designate a trustee who understands your vision. This level of control aids protect your properties from potential risks, while likewise offering tax obligation advantages and estate preparation benefits.Moreover, you can adjust your Trust as your conditions transform-- whether it's including new recipients, customizing terms, or addressing shifts in your monetary circumstance. By personalizing your overseas Trust, you not only safeguard your wealth however also produce a long lasting tradition that shows your worths and purposes.

Selecting the Right Jurisdiction: Factors to Consider for Your Offshore Trust

Choosing the right territory for your offshore Trust can significantly impact its effectiveness and benefits. When taking into consideration choices, think of the political stability and governing setting of the nation. A steady jurisdiction reduces threats associated with unexpected legal changes.Next, assess tax implications. Some territories supply tax obligation motivations that can improve your wide range defense technique. Additionally, think about the lawful structure. A jurisdiction with solid possession protection legislations can guard your possessions against possible claims - offshore trust.You need click over here to likewise show on privacy policies. Some countries supply better confidentiality, which can be vital for your satisfaction. Lastly, analyze the availability of neighborhood experts who can aid you, as their proficiency will certainly be crucial for taking care of the complexities of your Trust

Regularly Asked Concerns

What Are the Costs Connected With Establishing an Offshore Trust?

When developing an overseas Trust, you'll come across costs like setup costs, ongoing monitoring charges, lawful costs, and potential tax implications. It's vital to examine these prices versus the benefits before making a choice.

How Can I Gain Access To My Possessions Within an Offshore Trust?

To access your assets within an overseas Trust, you'll generally need to deal with your trustee - offshore trust. They'll direct you with the process, making certain conformity with regulations while facilitating your ask for circulations or withdrawals

Are Offshore Trusts Legal in My Country?

You must examine your country's regulations concerning overseas depends on, as regulations differ. Numerous nations permit them, however it's important to comprehend the legal effects and tax obligation obligations to ensure compliance and prevent potential issues.

Can an Offshore Trust Assist in Divorce Process?

Yes, an offshore Trust can potentially help in divorce process by safeguarding possessions from being split. Nonetheless, it's vital to speak with a lawful expert to ensure compliance with your neighborhood laws and guidelines.

What Happens to My Offshore Trust if I Modification Residency?

If you alter residency, your overseas Trust might still stay undamaged, however tax implications and legal factors to consider can differ. It's important to talk to a specialist to navigate these modifications and assurance conformity with guidelines. An offshore Trust is a lawful arrangement where you move your assets to a count on managed by a trustee in an international territory. You maintain control over the Trust while shielding your possessions learn the facts here now from neighborhood legal insurance claims and prospective creditors.Typically, you would certainly establish the Trust in a jurisdiction that has desirable laws, ensuring even more durable possession defense. Establishing an overseas Trust not only shields your assets but also offers considerable tax obligation advantages, particularly in estate tax obligation minimization. By positioning your possessions in an overseas Trust, you're not just safeguarding them from prospective financial institutions but also ensuring your economic information continues to be confidential.These trust funds operate under strict personal privacy laws that restrict the disclosure of your economic information to 3rd parties. You can keep control over your wide range while appreciating a layer of privacy that domestic counts on usually can not provide.Moreover, by utilizing an overseas Trust, you can decrease the threat of identity burglary and unwanted analysis from monetary establishments or tax authorities.

Comments on “How an Offshore Trust Can Facilitate International Investments”